Article

Cost Insurance Freight (CIF)

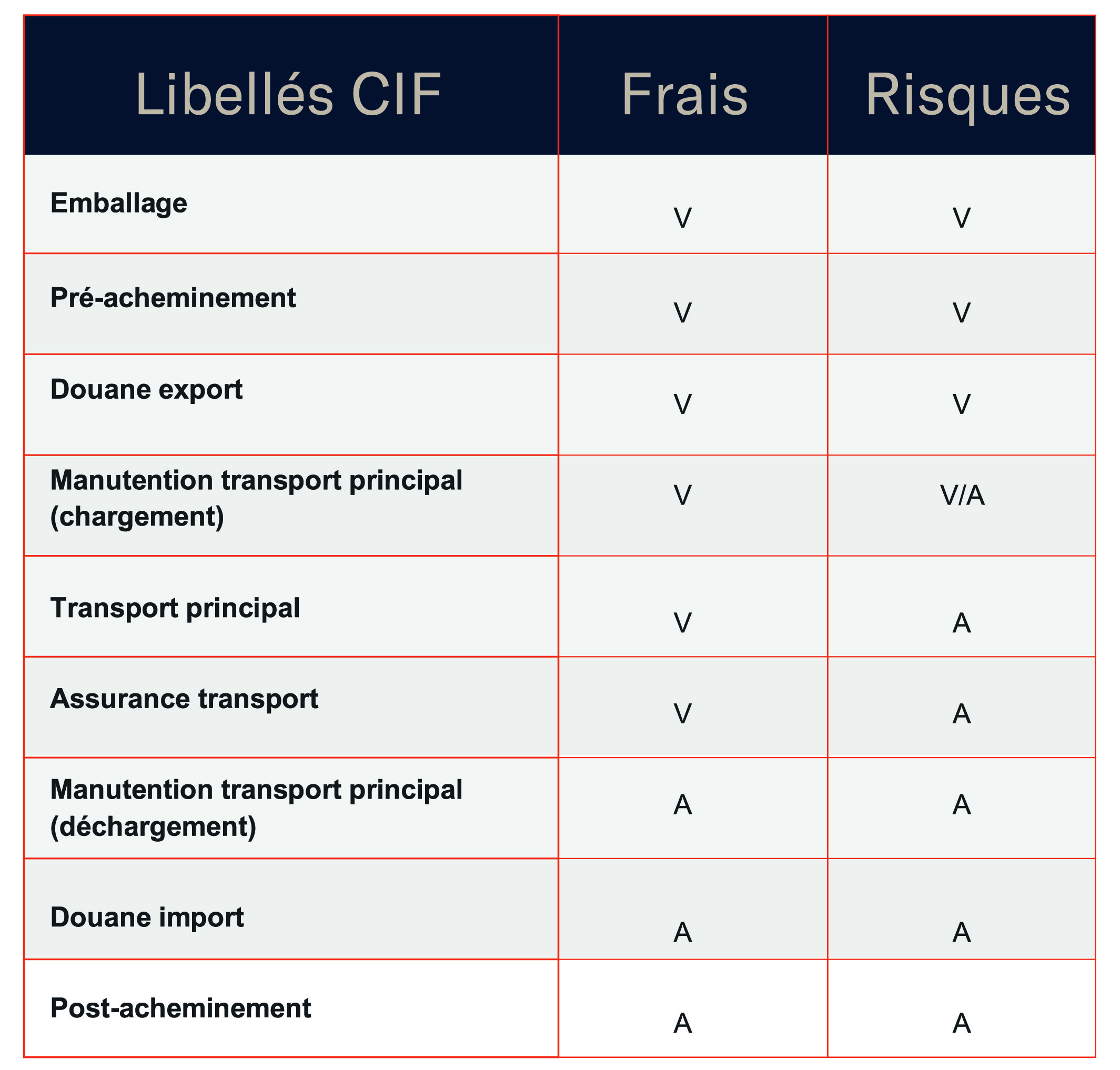

The Incoterms® rules were created to protect all stakeholders involved in an international freight transaction. Each of these Incoterms® rules clearly outlines the role of each party, specifying who bears the costs and/or risks for each of the steps involved in a given agreement.

The choice of the Incoterm® is the result of a commercial negotiation. One of the most popular Incoterm® rules is CIF, a rule that is particularly popular with buyers, as it frees them from several logistical formalities. That being said, it can also cause some disadvantages, especially when the supply chain faces serious setbacks.

Below are some more details to help you better understand the CIF rule, as well as the difficulties it generates as the supply chain is currently experiencing congestion issues at the Port of Montreal.

The Parties

The Seller

The seller chooses the carrier and covers all costs and freight up to the agreed port of destination, including the loading of custom-cleared goods on board of the ship, as well as any shipping formalities, except the unloading, which responsibility is assumed by the buyer. Risks are thus transferred at the same time as they are under the FOB rule.

The seller must also provide marine insurance to cover the risk of loss or damage to the goods. According to the Incoterms® CIF rule, the seller must provide a minimum insurance coverage in accordance with Clauses C from the Institute Cargo Clauses (ICC) or any other set of similar clauses. However, the parties can also agree to a higher level of coverage.

The Buyer

The buyer assumes all risks once the cargo is loaded onto the ship at the original port. The buyer is also responsible for receiving the goods from the carrier and unloading them at the agreed port of destination.

The Documentation Fees

The safety-related information and documents the buyer might require for the export and/or import and/or transport of the goods to the final destination may be provided by the seller upon request, at the buyer's expenses and risks.

The Disadvantages

The seller is therefore responsible for all matters relating to the transport via waterways. Here are the most common obstacles encountered by the seller:

- The carrier does not do any follow-ups, so the buyer has no idea when the ship will arrive at destination. When no Canadian freight forwarder is involved, there is often no one sending follow-ups.

- When documentation is incomplete, shipping lines are unsure who is responsible for the cargo once it arrives in Canada, which can cause delays before manifests are sent to the client.

- Terminal fees are often payable upon arrival at the Port of Montreal, and as the majority of clients do not have an account with the shipping lines, payment of these fees can cause delays. These delays may result in additional demurrage, detention and storage charges to be paid by the client BEFORE retrieving the cargo.

- With the shortage of chassis and drivers, it is becoming increasingly difficult to schedule a same day or next day pickup at the Port of Montreal. Now 2 to 3 weeks, and sometimes even more, are to be expected before getting an available pickup slot. Thus, if the cargo’s date of arrival is unknown, all of the surcharges above will apply, as the client won’t be able to pick up the cargo in a reasonable timeframe.

At Synergie, we are aware that some suppliers do not want to cooperate if the Incoterms® CIF rule isn’t involved. We have therefore developed personalized solutions for our clients to avoid the unreasonable demurrage and detention charges that many are currently forced to absorb.

Contact us today to discuss your situation and we will help you find a concrete and efficient solution to better manage the arrival of your cargos.